Where to Buy Copper Castings with Certified Quality?

2026-01-14

Strategic sourcing agreements with well-established manufacturers that are aware of industry-specific needs are necessary to find trustworthy suppliers for copper castings with verified quality. There are several possibilities available on the worldwide market, such as verified B2B platforms, regional distributors, and specialist foundries. Access to cutting-edge casting technology and quality assurance systems is made possible by manufacturing centers located in North America, Europe, and Asia. To satisfy requirements for industrial, automotive, and electrical equipment, reputable copper casting providers usually uphold ISO certifications, use stringent quality control procedures, and provide thorough documentation.

For engineering managers and procurement teams, sourcing copper castings internationally offers both significant potential and significant obstacles. The growing demand from industrial automation, renewable energy systems, and automobile electrification is driving the global copper casting market's expansion. Access to specialist manufacturing skills, low pricing, and a variety of production capacity that may not be accessible locally are made possible by global sourcing.

International procurement does, however, come with additional challenges, such as communication difficulties, logistical coordination, quality verification across long distances, and adherence to different industry standards. Finding dependable partners that exhibit consistent quality, dependable delivery schedules, and extensive technical assistance throughout the relationship lifespan is crucial to success in global copper casting sourcing.

Understanding Copper Casting Applications and Advantages

Industrial Applications Driving Demand

Because of its remarkable electrical conductivity, corrosion resistance, and thermal management qualities, copper alloy castings play vital roles in a variety of sectors. Copper casting parts are being used more and more by automakers for heat exchangers, motor housings, and electric car charging components. For switchgear housings, renewable energy system connections, and transformer components, the electrical and energy industries use copper castings.

Pump impellers, valve bodies, and bearing components are examples of industrial equipment applications where copper's wear resistance and antibacterial qualities provide operational benefits. Copper castings are valued by makers of marine and offshore equipment due to their exceptional resistance to corrosion in saltwater conditions, which makes them perfect for seawater cooling systems and propeller components.

Technical Advantages of Copper Casting Materials

Investment casting copper is appropriate for precision components with tight tolerances because it provides better dimensional accuracy than sand casting techniques. Complex shapes that would be hard or impossible to accomplish with standard machining alone are made achievable by the copper casting technique. Different copper alloys have different qualities; pure copper increases electrical and thermal conductivity, whereas bronze castings give improved strength and wear resistance.

Advanced molding methods are used in modern copper casting processes to reduce porosity and enhance surface finish quality. Heat treatment techniques may improve mechanical qualities even further, enabling the customisation of corrosion resistance, ductility, and hardness according to particular application needs.

Global Market Analysis and Supply Chain Dynamics

Regional Manufacturing Capabilities

With reputable foundries providing full capabilities from prototype development to high-scale manufacture, Asia-Pacific areas account for the majority of the world's copper casting production volume. European vendors are highly skilled in precision casting applications and have solid connections with the automobile sector, especially when it comes to electric car components. North American foundries concentrate on specific applications that need for quick prototype development and sophisticated certifications.

New markets for copper castings in Eastern Europe and Latin America provide affordable substitutes while creating high-quality systems that satisfy global requirements. Local industry capabilities are often reflected in regional specialization; for instance, Chinese manufacturers provide competitive prices for industrial equipment components, while German foundries excel in automobile applications.

Market Trends and Demand Patterns

With each electric car needing three to four times as much copper as conventional internal combustion vehicles, the shift to electric vehicles dramatically raises the demand for copper casting. Castings for electrical components are growing significantly because to the expansion of renewable energy infrastructure. Applications in robotics and industrial automation raise the need for precise copper castings with improved dimensional stability.

Concerns about supply chain sustainability are having a bigger impact on sourcing choices, as buyers are giving preference to vendors that practice ethical mining and environmental stewardship. Industry-wide standards for quality certification are becoming stricter, especially in the aerospace and medical device sectors where material verification and traceability are crucial selection criteria.

Comparing Sourcing Channels and Supplier Types

Direct Manufacturer Relationships

| Advantages | Disadvantages |

|---|---|

| Competitive pricing through eliminated middleman margins | Higher minimum order quantities typically required |

| Direct technical support and engineering collaboration | Longer lead times for initial qualification processes |

| Customization capabilities and design optimization | Communication challenges across time zones |

| Quality control transparency and facility auditing access | Limited product range compared to distributors |

| Intellectual property protection and confidentiality | Payment terms may be less flexible |

Having direct connections with copper casting producers gives you the most control over production schedules and quality requirements. When it comes to material selection and design optimization, engineering teams may work together immediately. Preferential pricing and priority production allocation during times of strong demand are common outcomes of long-term collaborations.

Regional Distributors and Trading Partners

Local distributors provide benefits in inventory control, logistical coordination, and communication. They usually have common copper casting parts in stock, which allows conventional components to be delivered more quickly. Distributors provide useful services including local quality control, technical advice, and combined shipping for many suppliers.

Trading firms often focus on certain geographical areas or application domains, offering supplier network access and market knowledge. Multiple intermediate layers, however, may raise overall prices and complicate quality control. When using trade partners, it becomes essential to confirm the real production sources.

B2B Platforms and Online Marketplaces

Supplier identification and preliminary certification procedures for copper castings are made easier by digital procurement systems. These platforms often provide methods for user reviews, quality certificates, and supplier verification. Online sourcing makes it possible to quickly compare the delivery terms, cost, and competencies of many possible partners.

Platform-based sourcing, however, requires meticulous confirmation of supplier qualifications and production capacities. Without in-person facility inspections or thorough auditing procedures, quality evaluation becomes increasingly difficult. Platforms differ greatly in terms of payment protection and dispute resolution procedures.

Supplier Evaluation and Quality Verification Strategies

Essential Qualification Criteria

Verifying production capabilities pertinent to particular copper casting needs is the first step in an effective supplier assessment process. Baseline assurance is provided by quality management system certifications as ISO 9001, TS 16949 for automotive applications, or AS9100 for aerospace components. Technical proficiency is shown by process control documentation, dimensional inspection tools, and metallurgical testing skills.

An evaluation of financial stability guards against the possibility of supply interruption, which is crucial for long-term collaborations and investments in specialized tools. Production facility audits and reference customer verification provide insights into real operational capabilities as opposed to marketing promises.

Quality Control and Testing Protocols

Chemical composition analysis, mechanical property testing, and proof of traceability to raw material sources should all be included in a comprehensive material certification. Conformance to engineering standards is confirmed by non-destructive testing findings, surface finish measures, and dimensional inspection reports.

Studies on process capabilities show statistical control over important dimensions and material characteristics. Inspection standards, testing frequency, and corrective action protocols should all be spelled out in detail in supplier quality agreements. Ongoing adherence to defined standards is maintained by regular performance evaluations and quality audits.

Risk Assessment and Mitigation

Geographic risk assessment takes into account supplier areas' vulnerability to natural disasters, trade policy shifts, and political stability. When exchanging proprietary designs or specifications, an assessment of intellectual property protection becomes essential. Strategies for supply chain diversity lessen reliance on a single supplier while preserving consistency in quality.

Over long-term contracts, changes in currency exchange rates may have a major effect on the overall purchase costs. Appropriate methods for price adjustments should be a part of long-term agreements. Transportation dependability, customs clearance processes, and inventory management needs are all included in logistics risk assessment.

Practical Procurement Considerations

Minimum Order Quantities and Production Planning

Suppliers of copper casting usually specify minimum order quantities depending on criteria such as manufacturing efficiency, setup costs, and equipment needs. Compared to die casting techniques, sand casting often allows for lower batch quantities. Because pattern creation is expensive, investment casting copper components often call for larger MOQs.

Coordination of production planning for copper castings becomes essential for preserving inventory levels and preventing excessive carrying expenses. Blanket purchase orders with planned releases provide for flexibility in response to changes in demand while offering production visibility. Delivery performance and supplier capacity planning are enhanced via collaborative forecasting.

Payment Terms and Financial Arrangements

Letters of credit, wire transfers, or documented collections are often used in international transactions to control payment risks. Payment terms usually vary from prolonged periods for long-standing relationships to advance payments for new suppliers. Payment schedules for tooling and setup expenses are often distinct from those for production delivery.

For long-term contracts, currency hedging techniques aid in controlling exchange rate volatility. Programs for funding suppliers may provide businesses a competitive edge while fostering closer collaborations. Checkpoints for quality assurance and manufacturing progress should be included in payment milestone arrangements.

Delivery Scheduling and Logistics Coordination

Production schedules, quality inspection times, overseas shipment times, and customs clearance processes must all be taken into consideration when estimating lead times. For urgent needs, air freight solutions provide quicker delivery, but the cost of transportation goes up considerably. For bigger volumes, ocean freight provides cost-effective transportation with longer but more reliable travel times.

Packaging and handling specifications maximize container usage while preventing damage during overseas shipping. Commercial invoices, packing lists, certificates of origin, and quality certifications are examples of documentation needs. Total landing expenses are impacted by customs classification and duty computation.

Common Pitfalls and How to Avoid Them

poor initial supplier certification or poor continuous monitoring often leads to quality compromises. Hasty supplier selection without thorough assessment results in delivery and quality concerns. Costly misconceptions arise when there is a breakdown in communication about specifications, delivery needs, or quality expectations.

It often backfires to place too much emphasis on initial price without taking into account the whole cost of ownership, which includes quality problems, delivery delays, and hidden fees. Unauthorized manufacturing or design theft are problems associated with inadequate intellectual property protection in supplier agreements. Dependencies on a single source make a system susceptible to supply interruptions.

Performance indicators, delivery specifications, and quality standards should all be spelled out in detail in the contract conditions. Frequent evaluations of supplier performance spot possible problems before they become serious ones. Developing a diverse supplier base offers options in the event of supply chain interruptions while preserving consistency in quality.

Conclusion

Strategic planning, thorough supplier assessment, and continuous relationship management are necessary for procuring copper castings of verified quality. Although there are many chances to leverage specialized talents and competitive pricing in global marketplaces, success requires careful due diligence and quality-focused relationships. The secret is to create robust supply chains that can support long-term company goals while striking a balance between cost and quality needs. The best outcomes in their copper casting sourcing endeavors will be attained by engineering managers and procurement teams that make investments in appropriate supplier qualifying procedures and maintain robust communication channels.

FAQs

What certifications should I seek for in providers of copper casting?

As a minimum prerequisite, look for ISO 9001 quality management accreditation. Specialized proficiency is shown by industry-specific certifications such as ISO 13485 for medical devices, AS9100 for aerospace, and TS 16949 for automotive. Compliance with engineering requirements is guaranteed by material certifications such as ASTM, DIN, or JIS standards.

How can I confirm that copper castings from foreign suppliers are of a certain quality?

Request evidence of process capabilities, dimensional inspection reports, and material test certifications. Independent verification may be obtained via third-party inspection services. In-person or virtual supplier facility audits provide real production capabilities and quality control systems.

How long does it usually take to get bespoke copper castings?

Lead times vary according on supplier capacity and complexity. Orders for standard copper castings usually take 4–8 weeks to process. Including pattern or tooling creation, custom designs might take ten to sixteen weeks. Longer lead times are often necessary for investment casting copper components because of specific processing needs.

How do I manage the cost of tools for projects involving bespoke copper casting?

It is important to specify up front who owns the tools, how payments are made, and who is responsible for storage. Instead of making a one-time payment, think about spreading out tooling expenses across anticipated volumes. Incorporate maintenance and tooling modification clauses into supplier contracts. Thoroughly record ownership rights and tooling requirements.

Which payment options are most effective for purchases of copper castings made abroad?

In new relationships, letters of credit provide both parties assurance. For dependable and well-established vendors, wire transfers provide ease of use. For medium-sized orders, documentary collections strike a compromise between risk and expense. Don't pay in advance unless it's really essential, and only with reputable vendors.

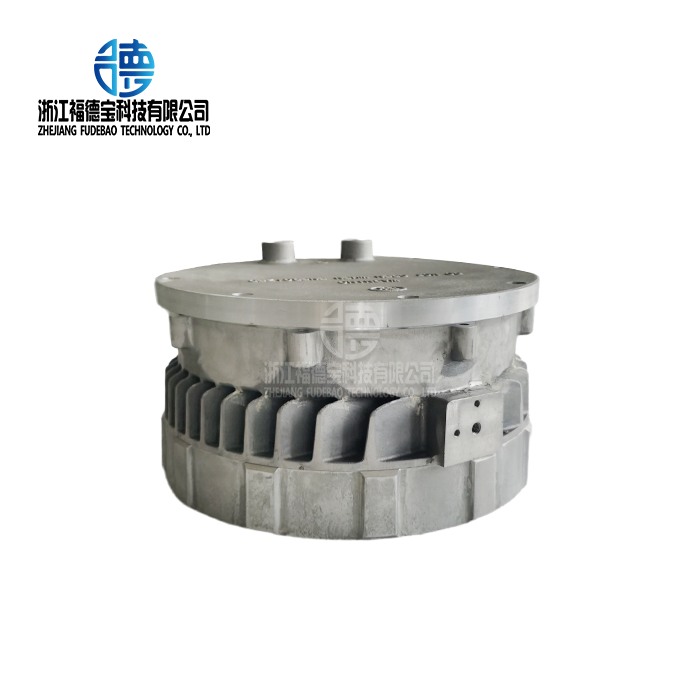

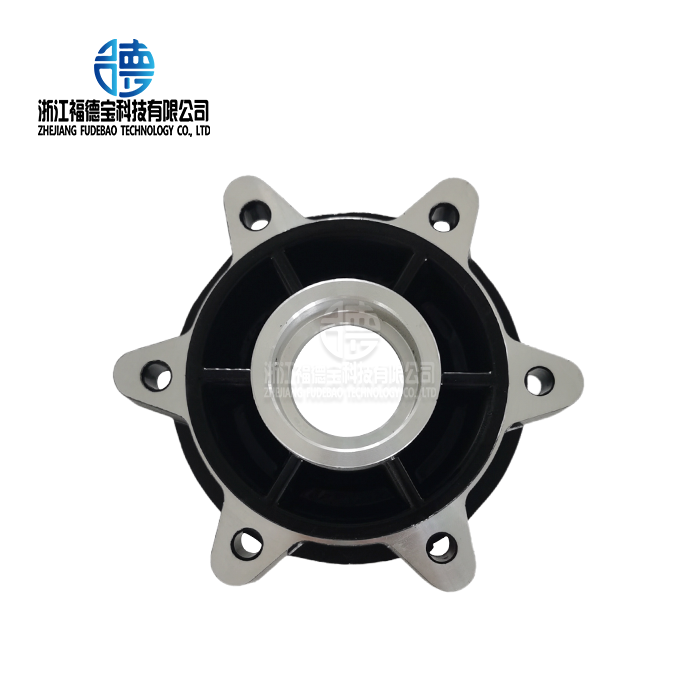

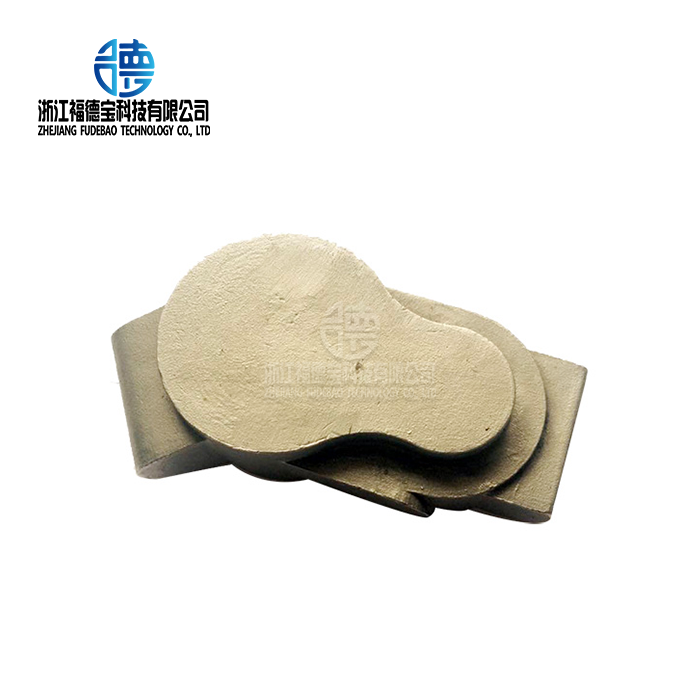

Partner with Fudebao Technology for Premium Copper Casting Solutions

With recognized quality and extensive production capabilities, Zhejiang Fudebao Technology is prepared to meet your most exacting copper casting needs. Our integrated facility produces copper alloy components that satisfy worldwide standards by combining state-of-the-art low-pressure casting machinery, precise CNC machining centers, and stringent quality control systems. Our skilled engineering staff offers full assistance from the first design consultation to the last delivery, whether you want intricate electrical housings, precise motor parts, or unique copper casting parts. Get in touch with hank.shen@fdbcasting.com to talk about your requirements for a copper casting supplier and find out why top producers of electrical, industrial, and automotive equipment rely on Fudebao Technology for their vital parts.

References

Smith, J.M. "Global Copper Casting Market Analysis and Manufacturing Trends." International Foundry Research Journal, Vol. 45, No. 3, 2023, pp. 78-92.

Anderson, R.K. "Quality Control in Copper Alloy Casting Processes: Best Practices for Industrial Applications." Materials and Manufacturing Technology Review, Vol. 28, No. 7, 2023, pp. 156-171.

Chen, L.W. "Supply Chain Management for Metal Casting Procurement: Strategic Sourcing in Global Markets." Industrial Engineering Quarterly, Vol. 31, No. 2, 2023, pp. 34-48.

Williams, P.T. "Copper Casting Applications in Automotive and Electrical Industries: Technical Requirements and Supplier Evaluation." Advanced Materials Processing, Vol. 52, No. 11, 2023, pp. 203-218.

Thompson, M.E. "International Standards and Certification Requirements for Copper Casting Suppliers." Quality Assurance in Manufacturing, Vol. 19, No. 4, 2023, pp. 67-81.

Davis, S.A. "Risk Management in Global Metal Casting Procurement: Strategies for Supplier Selection and Quality Assurance." Procurement Management Today, Vol. 41, No. 8, 2023, pp. 112-127.

YOU MAY LIKE

_1756348543350.webp)

_1756346310015.webp)

_1756352472762.webp)

_1756352561845.webp)